Carbon Accounting Tools Report

Developed with Lucid Capitalism. This report summarizes our assessment of the highest-quality carbon accounting tools in 2022 to help investors and operators pick what’s best for their organization.

In partnership with Lucid Capitalism.

If you don’t measure it, you can’t manage it.

To seriously tackle your company’s carbon emissions, you will need a tool that helps you keep track of them over time. This report summarizes our assessment of the highest quality carbon accounting tools in 2022 to help investors and operators pick what’s best for their organization.

Through market research, demos, and independent expert interviews, we reviewed over twenty carbon accounting tools in this analysis and narrowed it down to the top five tools for our members. Our target audience for this report includes venture capital firms, limited partners, and high-growth technology companies.1

We plan to update this landscape next year to capture what we expect to be substantial continued innovation and improvements among these tools. Here’s a brief outline of the document:

- Why now?

- What is carbon accounting?

- Key findings

- Questions you should ask in the buying process

- How each tool stacks up agains each other

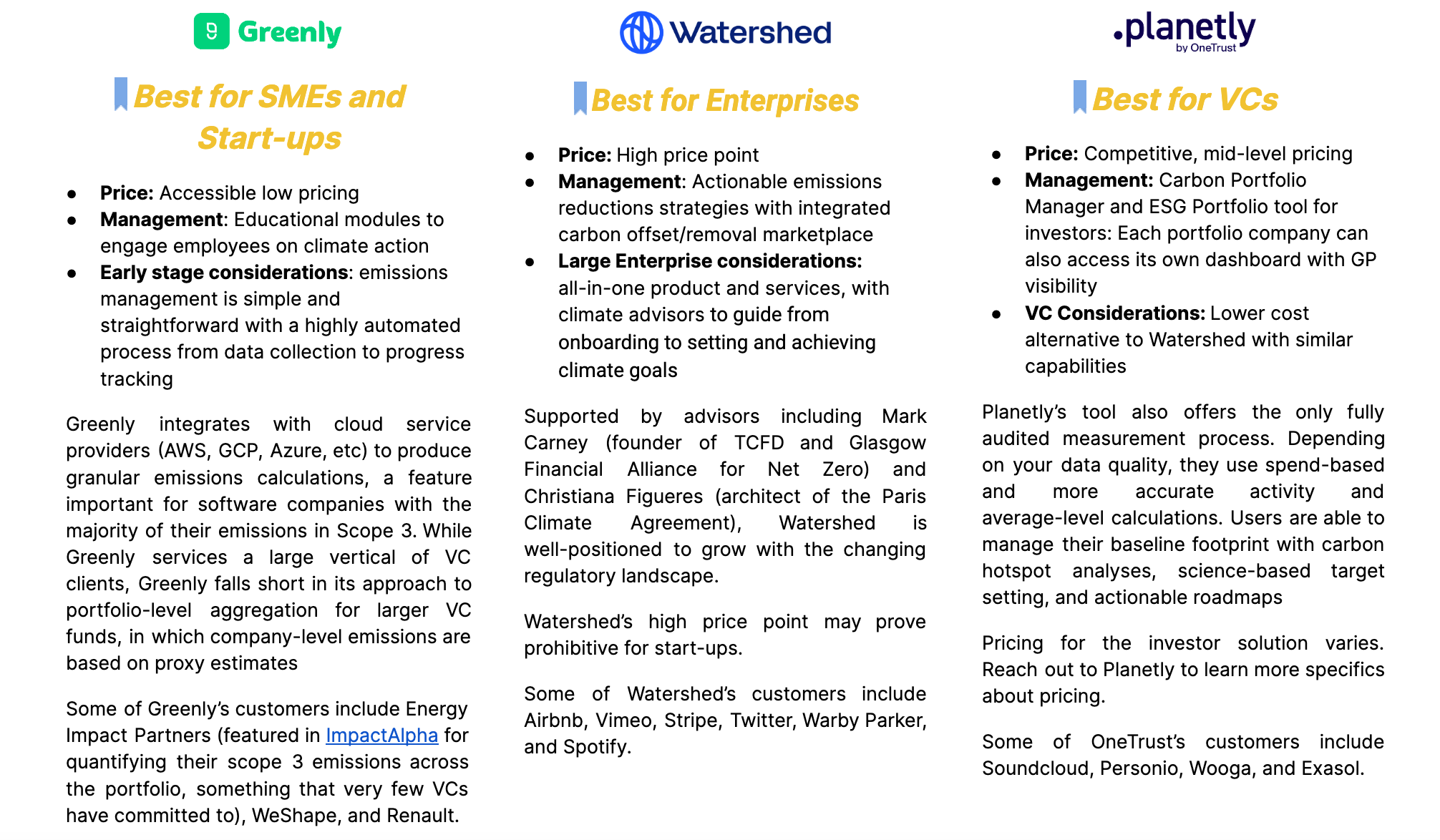

- Best tools for larger enterprises, best for SMEs or startups, and best for VCs

- Key terms and scoring criteria (appendix)

Carbon accounting is only one step in a company's climate strategy. At scale, a robust climate plan will incorporate strategies to actively reduce and manage all environmental externalities an organization is responsible for including, but not limited to, carbon emissions.

Why Now?

Greenhouse gas (GHG) emissions have increased since 2010 across major sectors globally, and fossil fuels and industry accounted for 65% of the total emissions in 2019 alone.2 These emission levels demonstrate that the goal of limiting warming to 1.5° Celsius is becoming less and less likely. With growing consensus and pressure for businesses to act, measuring our carbon footprint is becoming the standard for every industry. While tech company emissions only account for 23% of global emissions today, their share is projected to increase to over 14% by 2040,3 making the imperative to manage emissions early on even more pressing.

The carbon accounting industry is expected to grow by $9.1bn from 2021 to 2026, with main drivers being utilizing carbon accounting to identify areas for cost savings and regulatory pressure.4 Operating in a decarbonizing economy will require the uptake of these tools by companies of all sizes.

What Is Carbon Accounting?

Carbon accounting aims to quantify and aid an organization’s reporting of GHG emissions. This is important because recognizing the biggest emissions drivers in your organization enables more efficient management and reduction of your carbon footprint. Not only is there growing stakeholder pressure from investors, regulators, and consumers to account for emissions, but transitioning to lower-carbon practices also creates value: it reduces energy costs, mitigates supply-chain risk, and ensures organizations’ long-term viability in a decarbonized economy.5

As companies gain awareness of their emissions and responsibility to act, many have set ambitious climate goals—and subsequently rely on carbon offsets to reach those very goals. Carbon offsets are essentially reductions in carbon emissions (typically through projects such as reforestation and renewable energy production) to compensate for emissions elsewhere. While these offsets are popular among corporations, they cannot deliver the outcomes needed, as they effectively shift responsibility for emissions reductions to others—and allow companies to continue polluting. To credibly contribute to a reduction in global emissions, companies need to actively reduce their absolute carbon footprint and, if possible, support the removal of carbon from the atmosphere.6

Key Findings

Price as a current differentiator

The carbon accounting landscape is emerging and constantly changing as vendors offer more and more capabilities to stay competitive.7 While incumbents innovate, more nascent players jump in to capitalize in this young industry. Demonstrated in our landscape scoring, there is a relatively tight range of scores, confirming that carbon accounting tools do not currently have much differentiation on functionalities or services yet. That’s good news for buyers, as it means you have a number of decent options. At the moment, the most significant difference across tools and the ultimate deciding factor is price.

Why is there such a large price range? The wide range across tools is due to uncertainty in the value of carbon accounting across customer archetypes and the growing demand for lower-cost services for SMEs. Historically, more established players in the space capitalize on the highest-impact accounts, which are often large global enterprises and financial institutions. However, the space for small-business-focused carbon accounting tools is quickly becoming inundated with automated SaaS tools, which aim to reduce the need for high-touch consulting approaches. As carbon accounting becomes a must-have for companies, automated SaaS tools will be best able to rapidly meet the growing demand.

While the carbon accounting SaaS space is in its infancy, we expect the field to greatly improve its ability to produce accurate activity-based measurements, including upstream and downstream (Scope 3) emissions. In our assessment, many tools offered spend-based estimates, which takes the financial value of a purchased good or service and multiplies it by an emission factor. Spend-based estimates are less accurate than activity-level estimates, which utilize quantitative data (gallons of fuel consumed or miles traveled) to determine the emissions output of a given activity. Secondly, the field will also need to mature in its ability to service other budding industries such as Web 3.0, which is receiving increasing speculation for its energy-intensive characteristics.

We hope to provide a transparent view of this developing field to support the uptake of emissions management services by providing discounts to RIL members and, we hope, push the field towards greater accessibility.

Future-proofing is important

In this review we’ve focused on what these tools do today. But we recognize that, in markets where new tools are emerging and the whole category is still being defined, buying decisions can be as much about the expectation of future capabilities as about current ones. There are some tools, like Watershed, that appear to be emerging as leaders and putting together the resources, team and advisors to continue to be at the forefront of the industry. For many users, this future potential–although hard to evaluate–will be an important factor in the buying decision.

Additional findings regarding tools

- Tools are mostly aligned on covered scope: Our starting hypothesis was that all tools are aligned to GHG Protocol and SBTi and that all tools try to measure Scope 3 emissions. However, not all tools in our landscape were aligned to both standards and able to measure the majority of categories within Scope 3. Therefore, they were disregarded from our analysis. While Scope 3 remains the hardest to measure, it is an area ripe for improvement as it makes up the largest portion of a company’s footprint. We are beginning to see tools come into the market with a sole focus on measuring indirect emissions from upstream suppliers, remote home offices, and end-use of products.

- Tools are sector agnostic, with limited focus on software: Our starting hypothesis was that most carbon accounting tools would have the capacity to service consumer goods, hardware, and traditional industry sectors. Our analysis proved this correct as many tools are sector agnostic, and only a select few have focused on quantifying the emissions of a software-based company as identified below. Carbon accounting tools will become more useful as they develop more sector- and vertical-specific modeling and expertise, speeding integration and improving accuracy over time.

- Common features across tools: As we expected, most tools offered the following features: geographic flexibility to measure emissions across offices, recognition of transnational frameworks, multi-user access to the platform, and data storage capabilities. While most tools offer data storage of raw inputs, there are not clear data portability allowances from one tool to another because tools rely on proprietary models for footprint measurements. In terms of company systems, a few tools offer integrations with Quickbooks, NetSuite, and AWS, but coverage varies. We highly encourage you to discuss these topics with your sales rep when deciding on a tool to ensure that the one you choose will work with the systems you rely on.

Questions to Ask in the Buying Process

- Integration support: What kinds of services are included? How long does it typically take?

- Company System integrations: Does the tool integrate with your existing expense management and travel systems?

- Data Portability: Can you export your data from the tool and in what format?

- Future Proofing: Is the tool tracking all of the guiding carbon accounting frameworks that may be relevant to you?

Appendix

Landscape Scoring Factors

Industry Focus

- 5: high focus on tech, sector agnostic, and finance

- 4: high focus on tech and sector agnostic or sector agnostic and finance

- 3: sector agnostic,

- 2: limited focus on tech

- 1: does not include tech

Price

- 5 if low cost, 1 if most expensive

- Special discounts are also available for RIL members.

Startup Friendly

- Lite / Free tool that is approachable, simple and easy to use (2)

- Educational resources (1)

- Relevant to pre-product/early stage companies (1)

- Customizable to customer needs (1)

Data Hygiene

API integrations for automated data collection, portability (downloadable data)

- 5: multiple API/ERP integrations, flexible data uploads, downloadable data

- 4: a few API integrations, ability to add custom integrations by request

- 3: no APIs but releasing integrations soon, can export data

- 2: flexible data uploads (bulk files) and downloadable data

- 1: no APIs, no plans to include more integrations

Implementation

Ability to learn and implement tool into the company, interactive dashboard

- Ability to learn how to use the tool quickly (1pt)

- Ability to implement into company (through integrations, etc) quickly (1pt)

- Interactive dashboard (2pt)

- Requires only 1-2 introductory meetings to complete onboarding (1pt)

Quality and efficiency of customer service

Onboarding process to get all data uploaded and measurement process initiated

- 3pt: 1-2 week onboarding time to get data

- 2pt: 2-4 week onboarding

- 1pt: >4 week onboarding

AND

Responsiveness and quick responses throughout demo and introductory phase:

- 1pt: Relatively slower response time

- 2pt: Satisfactory responsiveness

Measure

- Measures scope 1, 2, and majority of scope 3 categories (1pt)

- Methodology is GHG Protocol Aligned (1pt)

- Measurement is based on spend and activity-based data (1pt)

- Benchmarking (1pt)

- Forward-looking emissions projections (1pt)

Report

- Supports reporting to international frameworks such as CDP, SFDR, etc (2pt)

- Customized stakeholder reporting (1pt)

- Auto populated reporting to international frameworks (ex. CDP) (1pt)

- Reporting can be aligned to TCFD (1pt)

Manage

- Can set net-zero, science-aligned targets (2pt)

- Actionable emissions reductions strategies (1pt)

- Creates roadmap with scenario modeling (2pt)

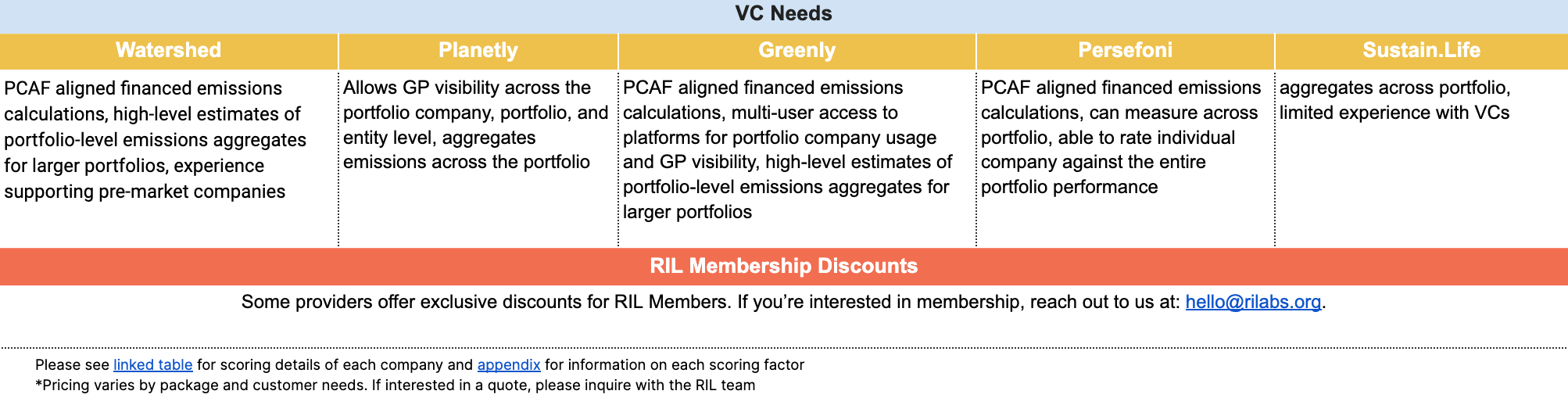

VC Needs

- Ability to quantify financed emissions (2pt)

- Can aggregate across portfolios (1pt)

- Identifies portfolio hotspots (1pt)

- Has extensive experience with VCs (1pt)

Key Terms

The following section will define some of the most relevant sustainability concepts and stakeholders, as well as goals that the private sector can set to take an active approach in the climate crisis solution.

Climate Goals

- Net Zero: Achieving net zero means the total elimination of greenhouse gas emissions from society. This occurs through carbon removals equivalent to an organization’s emissions. Along with science-based targets, this is the most comprehensive decarbonization goal an organization can set.

- Science Based Targets (SBTs): Science Based Targets are greenhouse gas emission goals that keep the increase in global temperature below 2 degrees Celsius compared to pre-industrial times.

- Carbon Neutral: Achieving carbon neutrality means that an entity makes no net positive carbon emissions. This requires a company or organization offsetting its carbon emissions through numerous options.

- Carbon Positive: Carbon positive refers to a company or organization whose carbon emissions are greater than zero. All carbon positive companies play a role in global warming.

Emissions Scopes

- Scope 1 are all emissions from an organization-owned source. This includes vehicle and furnace combustion.

- Scope 2 emissions are indirect, often purchased, sources such as electricity and heat.

- Scope 3 emissions make up the majority of an organization’s overall emissions. They encompass emitting unowned and uncontrolled resources throughout an organization’s value chain. Data center usage emissions, which make up the majority of Scope 3 emissions for tech companies, are projected to be 14% of global emissions by 2040.

Guiding Bodies

- GHG Protocol: global standardized frameworks to measure and manage greenhouse gas (GHG) emissions

- Science Based Target Initiative (SBTi): guidance for emissions reduction target setting, reporting, and disclosing. Also provides sector-specific guidance

- Task Force on Climate-Related Financial Disclosures (TCFD): recommendations to improve reporting of climate-related financial information

- Sustainability Accounting Standards Board (SASB): sets standards for the disclosure of financially material sustainability information by companies to their investors. SASB recently consolidated into the international Sustainability Standards Board (ISSB).

- CDP Worldwide: global environmental disclosure system, companies disclose their environmental impacts through self-reported questionnaires

- Partnership for Carbon Accounting Financials (PCAF): global partnership of financial institutions that work together to develop and implement a harmonized approach to assess and disclose the greenhouse gas (GHG) emissions associated with their loans and investments.

Carbon Offsets and Carbon Removal

- An offset generally represents 1 ton of CO2 equivalent, which can be purchased by a company to compensate for their emissions.

- A carbon removal is when a company pays to remove carbon from the atmosphere in order to cancel its own emissions.

1 There are tools that focus on particular industries that are generally less relevant to RIL members, like heavy industries, fleet transportation, manufacturing, etc. If those are relevant to you, feel free to reach out and we can share more information about what we found.

2 IPCC Sixth Assessment Report: Summary for Policymakers

3 Assessing ICT global emissions footprint: Trends to 2040 & recommendations - ScienceDirect

4 Carbon Accounting Software Market - 37% of Growth to Originate from North America| Evolving Opportunities with Carbon Analytics Ltd. & CarbonetiX| 17000+ Technavio Reports

5 How to prepare your business for the low-carbon economy

6 For more information on the critiques of carbon offsets, see the following articles: Stockholm Environment Institute and GHG Management Institute, Yale E360, GreenBiz

7 We reviewed over 20 carbon accounting tools in this analysis through market research, demos, and expert interviews. Companies that were ranked below the top 5 (in descending order): Normative, Plan A, Supercritical, Reporting 21, Sphera, Sinai, Emitwise, Arcturus.io, LFCA, Climax Community, EarthUp, Climatiq, Measurabl, Envizi, Spherics.

View the article here.

Additional Resources and Tools

Get started on the things you can control: